Applying for a loan can be a daunting process, but it doesn’t have to be a minefield. One of the most important things to remember is to always shop around for the best rates and terms, as settling for the first offer you see could end up costing you big time. Another dangerous mistake to avoid is not checking your credit score beforehand, as a low score can lead to higher interest rates or even denial of your application. And lastly, positive mindset plays a crucial role, don’t apply for a loan unless you’re confident in your ability to repay it. By being aware of these top mistakes, you can navigate the loan application process with confidence.

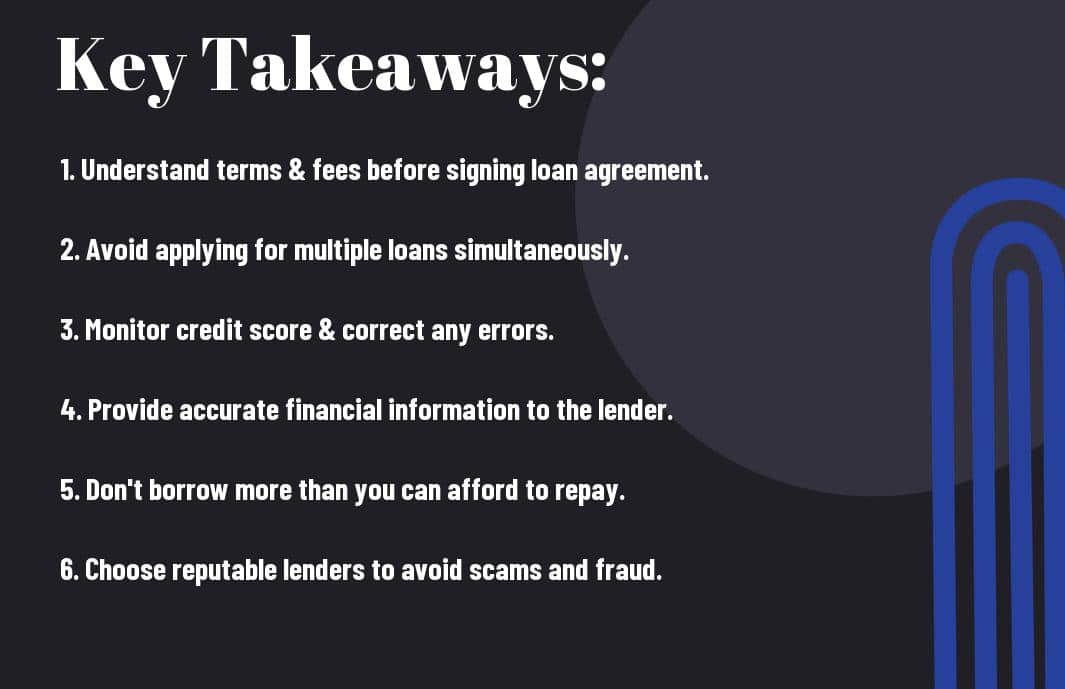

Key Takeaways:

- Underestimating the importance of credit score: Your credit score plays a critical role in determining your loan approval and interest rates. Make sure to maintain a good credit score before applying for a loan.

- Not comparing loan options: It’s imperative to shop around and compare different lenders to find the best loan terms for your situation. Don’t settle for the first offer you receive.

- Ignoring the fine print: Before signing any loan agreement, carefully read and understand all the terms and conditions. Don’t overlook any fees, penalties, or clauses that may impact your repayment process.

The Loan Application Hustle

Ignoring Your Credit Score: A Deadly Sin

Some people underestimate the power of their credit score when it comes to loan applications. Your credit score is the key that unlocks the doors to favorable loan terms and interest rates. Ignoring it is like going into a battle without a weapon. Don’t make this deadly mistake!

Income Inconsistencies: Don’t Fake the Funk

To Credit is everything when it comes to loan applications. Fudging your income numbers or providing inconsistent information to lenders can backfire in a major way. Lenders use your income to assess your ability to repay the loan. If they catch you in a lie, you can kiss that loan approval goodbye. Keep it real and authentic!

Another important thing to note about income inconsistencies is that even if you manage to secure a loan with false information, you may struggle to make the payments in the long run. Lying about your income to get a larger loan amount can lead to financial stress and even defaulting on the loan. It’s not worth the risk!

The Nitty-Gritty of Documentation

Skimping on Paperwork: Cutting Corners Costs

Many loan applicants make the mistake of skimping on paperwork to save time or effort, but this can end up costing them dearly in the long run. Proper documentation is crucial for lenders to assess your financial situation accurately and make an informed decision about your loan application. Failing to provide all the necessary paperwork can lead to delays or even outright rejections. It’s worth taking the time to gather all required documents and present them in an organized manner to increase your chances of approval.

The Curse of Careless Errors: Attention to Detail is Key

The smallest error in your loan application can have significant consequences. From misspelled names to incorrect account numbers, any mistake can raise red flags for lenders and result in your application being denied. The key to avoiding this curse is paying close attention to every detail on your paperwork. Double-check all information before submitting your application to ensure accuracy. Bear in mind, meticulousness can make or break your loan approval.

Understanding the importance of thorough documentation and attention to detail is crucial when applying for a loan. Missing or incorrect information can lead to delays, rejections, or even higher interest rates. By being meticulous and organized in your paperwork, you demonstrate to lenders that you are a responsible borrower. Take the time to review and verify all documents to present a strong and error-free loan application.

Mindset and Methods

Desperation is a Terrible Perfume: Stay Calm and Prepared

All too often, people make the mistake of approaching lenders with a sense of desperation. Let me tell you, that is a terrible fragrance to wear when seeking a loan. When you’re frantic or anxious, lenders can smell it a mile away. Stay calm and prepared. Know your financial situation inside out, have all your documents in order, and approach the process with confidence. Recall, you’re in control of the situation, not the other way around.

Shooting Blindly: Why Not Researching Lenders Leads to Regret

Anytime you decide to seek a loan without doing your due diligence on lenders, you’re crucially shooting blindly. Not all lenders are created equal, and some may take advantage of your lack of knowledge. Researching lenders allows you to compare interest rates, terms, and reputation. You don’t want to end up with a loan that has outrageous fees or unfair terms, do you?

It’s crucial to compare multiple lenders to find the best fit for your financial needs. Look for reputable institutions with positive reviews and transparent terms. Don’t be swayed by flashy ads or promises of instant approval – take the time to do your homework and make an informed decision. Your wallet will thank you later.

Strings Attached

Now, when you’re applying for a loan, it’s important to be aware of any potential strings attached. For more insights on personal loan mistakes, check out 6 Common Personal Loan Mistakes and How to Avoid Them.

The Fine Print Fiasco: Read or Weep

To avoid falling into a fine print fiasco, make sure to carefully read all the terms and conditions of your loan agreement. Don’t skim through the document – pay attention to details like interest rates, fees, and repayment terms. Ignoring the fine print could lead to unexpected costs and financial stress down the road.

Term Troubles: Why Longer Isn’t Always Better

The temptation to opt for a longer loan term may seem appealing due to lower monthly payments, but it could cost you more in the long run. Longer loan terms typically mean paying more interest over time, increasing the total cost of the loan. Consider the impact on your overall financial health and choose a term that aligns with your repayment goals.

Read through the terms and conditions carefully before signing on the dotted line. Look for any hidden fees or penalties that may apply, especially if you plan to pay off the loan early. Understanding the terms upfront can save you from financial surprises.

Conclusion

Now you know the top mistakes to avoid when applying for a loan! Note, it’s crucial to have a clear understanding of your financial situation, shop around for the best rates, and avoid taking on more debt than you can handle. By steering clear of these common pitfalls, you can set yourself up for success and secure the financing you need to reach your goals. Stay vigilant, do your research, and make smart financial decisions. Keep hustling!

FAQ

Q: What is the first mistake to avoid when applying for a loan?

A: Neglecting to check your credit score before applying for a loan is a big no-no. Lenders use this to assess your creditworthiness, so make sure yours is in good shape.

Q: How important is it to compare loan options before making a decision?

A: It’s crucial! Don’t just settle for the first loan offer you receive. Take the time to compare interest rates, terms, and fees to find the best deal for your financial situation.

Q: Is it a mistake to borrow more than you can afford to repay?

A: Absolutely. Borrowing beyond your means can lead to financial stress and potentially defaulting on the loan. Be realistic about what you can comfortably repay.

Q: Should I be mindful of the fine print when signing loan documents?

A: Always! Don’t skim through the terms and conditions. Make sure you understand all the details of the loan agreement, including any hidden fees or penalties.

Q: Is it wise to neglect creating a repayment plan for the loan?

A: Not at all. Having a clear repayment plan can help you stay on track and avoid missing payments. Budget accordingly to ensure you can meet your obligations.

Q: Can overlooking additional fees and charges be detrimental when applying for a loan?

A: Definitely. Be aware of all the additional costs associated with the loan, such as origination fees or prepayment penalties. Factor these into your decision-making process.

Q: Should I avoid applying for multiple loans at the same time?

A: Yes, applying for multiple loans simultaneously can hurt your credit score and make you appear desperate to lenders. Be strategic and apply for loans that best fit your needs.