The decision to take out a personal loan can be a game-changer in your financial journey. Personal loans offer a quick and easy way to secure funds for various purposes, from consolidating debt to funding a home renovation. However, before diving headfirst into the world of personal loans, it’s crucial to weigh the pros and cons to make an informed decision. Let’s break down the benefits and risks associated with taking out a personal loan.

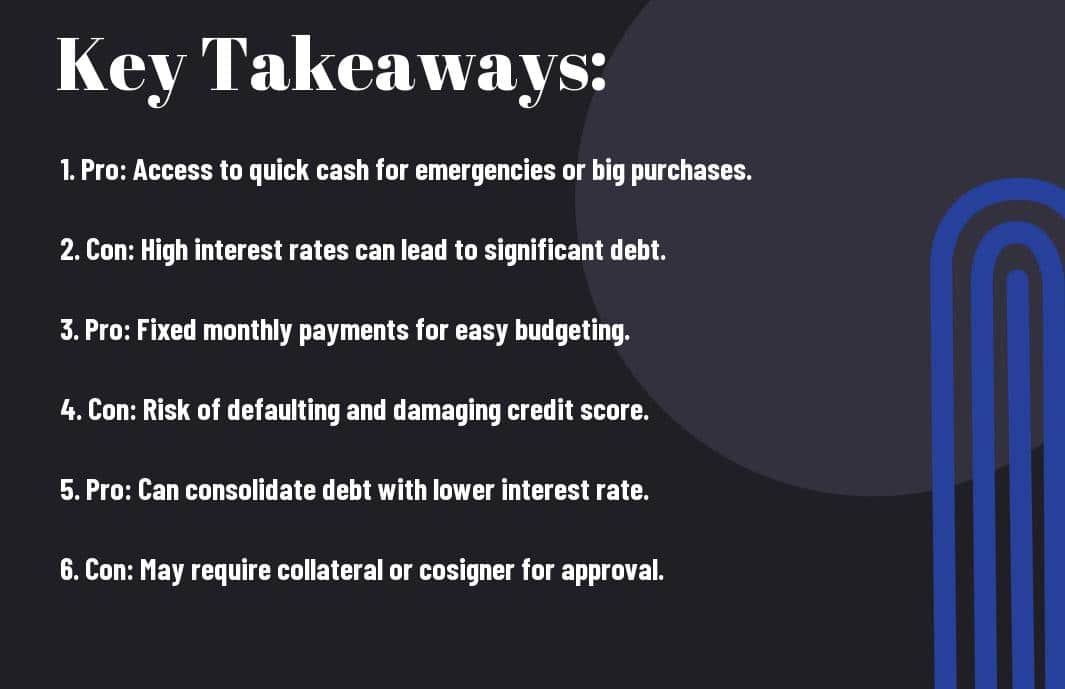

Key Takeaways:

- Flexibility: Personal loans offer flexibility in how the funds can be used, from consolidating debt to funding a major purchase.

- Fixed interest rates: Personal loans typically have fixed interest rates, making it easier to budget for monthly payments.

- High interest rates: One of the main drawbacks of personal loans is that they often come with higher interest rates compared to other types of loans, such as secured loans.

The Upside: Advantages of Personal Loans

Quick Cash, When You Need It Most

When you’re in a pinch and need cash fast, personal loans can be a lifesaver. Whether it’s unexpected medical bills, car repairs, or a home improvement project, personal loans provide quick access to the funds you need to cover expenses without having to wait.

Credit Boosting Potential

For those looking to improve their credit score, personal loans can be a great tool. By making timely payments on your loan, you can demonstrate your ability to manage debt responsibly. This positive payment history can help boost your credit score over time, making it easier to qualify for better loan terms in the future.

Loans can help build your credit as long as you make on-time payments and manage your debt responsibly. However, missing payments can have a negative impact on your credit score. It’s important to borrow only what you can afford to repay to avoid damaging your credit.

The Downside: Disadvantages of Personal Loans

Your Pros and Cons of Personal Loans journey wouldn’t be complete without understanding the potential pitfalls of taking out a personal loan. While they can be a helpful financial tool, there are some downsides to consider.

The Interest Rate Game

For those considering a personal loan, the interest rate is a crucial factor to pay attention to. Personal loans often come with higher interest rates compared to other types of loans, especially if you have a less-than-stellar credit score. These higher rates can result in you paying significantly more over time, so it’s important to shop around for the best rate before committing to a loan.

Debt Traps and Pitfalls

Personal loans can sometimes lead to debt traps and pitfalls if not managed wisely. One common danger is using a personal loan to pay off existing debts, only to rack up more debt shortly after. This can create a cycle of borrowing that becomes difficult to break free from. Additionally, missing payments or defaulting on a personal loan can have serious consequences, including damaging your credit score and potentially facing legal action from the lender.

Plus, the convenience of getting quick cash through personal loans can sometimes lead to impulse spending, which may not align with your long-term financial goals. It’s crucial to have a clear plan for how you will use the funds and a solid repayment strategy in place to avoid falling into the debt trap.

Be cautious and strategic when considering a personal loan, making sure that you fully understand the terms and potential risks involved. By being proactive and responsible in your borrowing, you can utilize personal loans as a beneficial financial tool rather than a financial burden.

Making The Choice: Is A Personal Loan Right For You?

Assessing Your Financial Health

Right before you even think about taking out a personal loan, you need to assess your financial health. Take a hard look at your income, expenses, savings, and outstanding debts. Make sure you have a clear idea of your financial situation before committing to borrowing more money.

Big Picture: Goals and Consequences

The important thing to remember when considering a personal loan is the big picture. The choices you make now can have long-term consequences. Think about your goals and how this loan could help or hinder you in achieving them. Consider the interest rates, repayment terms, and potential impact on your credit score.

Personal loans can provide you with the extra cash you need for emergencies or opportunities, but tread carefully. The dangerous part lies in taking on more debt than you can handle and ending up in a cycle of borrowing. On the positive side, a personal loan can help you consolidate debt, improve your credit score with timely payments, and achieve your financial goals faster.

Final Words

Hence, when considering whether to take out a personal loan, it’s crucial to weigh the pros and cons carefully. Personal loans can provide quick access to funds for emergencies or large purchases, but they also come with the responsibility of repayment and interest. Make sure to understand the terms and conditions of the loan, shop around for the best rates, and only borrow what you can afford to pay back. Recall, financial decisions should always be made with a clear plan in mind to avoid unnecessary debt and stress. Stay smart, do your research, and make informed choices that align with your financial goals. You’ve got this! 🚀

FAQ

Q: What are the pros of taking out a personal loan?

A: Personal loans can provide quick access to funds, have a fixed interest rate, and can be used for a variety of purposes like debt consolidation or home improvements.

Q: What are the cons of taking out a personal loan?

A: Personal loans often come with higher interest rates compared to other forms of borrowing, and missing payments can negatively impact your credit score.

Q: How can a personal loan help me consolidate debt?

A: By taking out a personal loan to pay off multiple debts, you can streamline your payments into one, potentially lower your interest rate, and simplify your financial planning.

Q: Can I use a personal loan for emergency expenses?

A: Yes, personal loans can be a good option for covering unexpected costs like medical bills or car repairs when you don’t have enough savings on hand.

Q: Is it wise to take out a personal loan for discretionary expenses?

A: It’s generally not recommended to use a personal loan for non-important purchases like vacations or shopping sprees, as it can lead to unnecessary debt and interest charges.

Q: How does my credit score affect my ability to get a personal loan?

A: Your credit score plays a significant role in determining the interest rate you’ll receive on a personal loan and whether or not you’ll be approved by lenders.

Q: What should I consider before taking out a personal loan?

A: Before applying for a personal loan, evaluate your financial situation, compare offers from multiple lenders, and make sure you understand the terms and repayment schedule to ensure it aligns with your budget and goals.